The ICAI has released the CA Intermediate New Syllabus 2025 for the May 2025 exams. Students can download the syllabus pdf from the BoS portal of the official ICAI website or this page.

The CA Intermediate course includes six subjects divided into two groups—Groups 1 and 2. Before preparing for the Intermediate exams, students must review the complete syllabus of each subject to determine the topics that need to be covered. The syllabus will also contain the topic marking scheme.

Furthermore, the ICAI has recently proposed a new CA syllabus, under which the institute has reduced the CA intermediate subjects from 8 to 6. Check all the details of the CA New Scheme here. You can also join the CA Inter Online Classes for preparation.

So, In this article, you’ll learn the CA Intermediate New syllabus and subjects for the May 2025 exams according to the ICAI study material. Furthermore, we have also mentioned the marks weightage and exam pattern.

Must Check: CA Inter admit card

ICAI CA Intermediate New Subjects Syllabus 2025

Paper-1: Advance Accounting (100 Marks)

The whole CA Inter Advanced Accounts syllabus 2025 is separated into 3 Modules, and students should go through each of them in detail. ICAI has added 15 chapters to the Advanced Accounting syllabus for 2025. Check the table below to know the CA Intermediate syllabus 2025 for Paper 1, i.e., Advance Accounting.

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Introduction to Accounting Standards | |

| Chapter 2: Framework for Preparation and Presentation of Financial Statements | |

| Chapter 3: Applicability of Accounting Standards | |

Chapter 4: Presentation and Disclosures Based Accounting Standards

| |

Module-2 | |

Chapter 5: Assets Based Accounting Standards

| |

Chapter 6: Liabilities Based Accounting Standards

| |

Chapter 7: Accounting Standards Based on Items Impacting Financial Statement

| |

Chapter 8: Revenue Based Accounting Standards

| |

Chapter 9: Other Accounting Standards

| |

Chapter 10: Accounting Standards for Consolidated Financial Statement

| |

Module-3 | |

Chapter 11: Financial Statements of Companies

| |

| Chapter 12: Buyback of Securities | |

| Chapter 13: Amalgamation of Companies | |

| Chapter 14: Accounting for Reconstruction of Companies | |

| Chapter 15: Accounting for Branches including Foreign Branches |

Must Read: CA Course

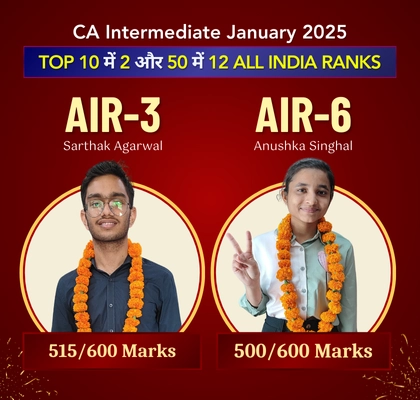

Join the VSI CA Intermediate classes now and learn from the best CA faculty.

Paper-2: Corporate and Other Laws:

Below is the detailed CA Intermediate syllabus of Corporate and Other Law. Candidates appearing for the Intermediate exam should review all the topics of the CA Inter Law syllabus. You can also check the modules available at boslive.icai.org.

Part I. Company Law (The Companies Act, 2013 – Sections 1 to 148)

Objective: The students here will develop an understanding of the provisions of company law. Apart from that, they’ll learn how to address application-oriented issues.

Part II. Other Laws

Objective: To make the students understand the selected legislation’s provisions and learn to address the application-oriented issues. The students will also understand the rules for the interpretation of statutes.

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Preliminary | |

| Chapter 2: Incorporation of Company and Matters Incidental Thereto | |

| Chapter 3: Prospectus and Allotment of Securities | |

| Chapter 4: Share Capital and Debentures | |

| Chapter 5: Acceptance of Deposits by Companies | |

| Chapter 6: Registration of Charges | |

Module-2 | |

| Chapter 7: Management & Administration | |

| Chapter 8: Declaration and Payment of Dividend | |

| Chapter 9: Accounts of Companies | |

| Chapter 10: Audit and Auditors | |

| Chapter 11: Companies Incorporated Outside India | |

Module-3 | Chapter 12: The Limited Liability Partnership Act, 2008 |

Module-3 (Part-II Other Laws) | |

| Chapter 1: The General Clauses Act, 1897 | |

| Chapter 2: Interpretation of Statutes | |

| Chapter 3: The Foreign Exchange Management Act, 1999 |

Students can also read the CA Intermediate Study Plan for the May 2025 exams.

Paper-3: Taxation

CA Inter Taxation is a subject that requires continuous revisions. The CA Inter syllabus for taxation is divided into two parts: Income tax law and indirect taxes. The table below provides a detailed Taxation syllabus for the 2025 exams. Check the official modules at boslive.icai.org.

Objective: To understand the provisions of Income Tax law & GST law, and apply the acquired knowledge in computations and address the application-oriented issues.

Section A: Income Tax Law (50 Marks)

Syllabus Modules | Chapters |

Module-1 | |

| Section I Chapter 1: Basic Concepts Chapter 2: Residence and Scope of Total Income | |

| Section II Chapter 3: Heads of Income | |

Module-2 | |

| Section III Chapter 4: Income of Other Persons included in Assessee’s Total Income Chapter 5: Aggregation of Income, Set-Off and Carry Forward of Losses Chapter 6: Deductions from Gross Total Income | |

| Section IV Chapter 7: Advance Tax, Tax Deduction at Source and Tax Collection at Source Chapter 8: Provisions for filing Return of Income and Self Assessment | |

| Section V Chapter 9: Income Tax Liability – Computation and Optimisation |

Section B: Goods and Service Tax (50 Marks)

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: GST in India – An Introduction | |

| Chapter 2: Supply under GST | |

| Chapter 3: Charge of GST | |

| Chapter 4: Place of Supply | |

| Chapter 5: Exemptions from GST | |

| Chapter 6: Time of Supply | |

| Chapter 7: Value of Supply | |

Module-2 | |

| Chapter 8: Input Tax Credit | |

| Chapter 9: Registration | |

| Chapter 10: Tax Invoice; Credit and Debit Notes | |

| Chapter 11: Accounts and Records | |

| Chapter 12: E-Way Bill | |

| Chapter 13: Payment of Tax | |

| Chapter 14: Tax Deduction at Source and Collection of Tax at Source | |

| Chapter 15: Returns |

Paper-4: Cost and Management Accounting (100 Marks)

The CA Intermediate syllabus 2025 for paper 3, i.e., Cost and Management Accounting, is given below in the table. Every topic of the CA Intermediate costing syllabus is important for students, as it is also a scorable subject. You can also checkout the official modules at boslive.icai.org.

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Introduction to Cost and Management Accounting | |

| Chapter 2: Material Cost | |

| Chapter 3: Employee Cost and Direct Expenses | |

| Chapter 4: Overheads – Absorption Costing Method | |

| Chapter 5: Activity Based Costing | |

| Chapter 6: Cost Sheet | |

| Chapter 7: Cost Accounting Systems | |

Module-2 | |

| Chapter 8: Unit and Batch Costing | |

| Chapter 9: Job Costing | |

| Chapter 10: Process and Operation Costing | |

| Chapter 11: Joint Products and By Products | |

| Chapter 12: Service Costing | |

| Chapter 13: Standard Costing | |

| Chapter 14: Marginal Costing | |

| Chapter 15: Budgets and Budgetary Control |

Check out the CA Intermediate Group 1 study plan for the May 2025 exams.

Paper 5: Auditing and Assurance:

The CA Intermediate syllabus 2025 for auditing and assurance is given below.You can also checkout the official modules at boslive.icai.org.

Objective: To understand the concepts of auditing and the generally accepted auditing procedures, techniques, and skills. Other than that, acquire the ability to apply the knowledge in audit and attestation engagements.

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Nature, Objective and Scope of Audit | |

| Chapter 2: Audit Strategy, Audit Planning and Audit Programme | |

| Chapter 3: Risk Assessment and Internal Control | |

| Chapter 4: Audit Evidence | |

| Chapter 5: Audit of Items of Financial Statements | |

Module-2 | |

| Chapter 6: Audit Documentation | |

| Chapter 7: Completion and Review | |

| Chapter 8: Audit Report | |

| Chapter 9: Special Features of Audit of Different Type of Entities | |

| Chapter 10: Audit of Banks | |

| Chapter 11: Ethics and Terms of Audit Engagements |

Must Check: All Details of CA Intermediate Auditing and Assurance

Paper-6: Financial Management and Strategic Management (100 Marks)

This CA Intermediate subject is divided into 2 sections, namely – Finance Management and Strategic Management. The syllabus for both sections is mentioned in the table below. While studying for paper 6, the students will learn about information systems and how it is making their impact on processes and controls.You can also checkout the official modules at boslive.icai.org.

Section A: Financial Management

The last subject of the CA Intermediate Syllabus 2025 deals with Financial management and is also divided into 2 sections. The first part is financial management, and the second part is economics for finance. The table below shows the CA Intermediate syllabus for paper 6.

Objective: To understand different aspects offinancial managementt and apply such knowledge in decision-making.

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Scope and Objectives of Financial Management | |

| Chapter 2: Types of Financing | |

| Chapter 3: Financial Analysis and Planning – Ratio Analysis | |

| Chapter 4: Cost of Capital | |

| Chapter 5: Financing Decisions – Capital Structure | |

| Chapter 6: Financing Decisions – Leverages | |

Module-2 | |

| Chapter 7: Investment Decisions | |

| Chapter 8: Dividend Decision | |

| Chapter 9: Management of Working Capital |

Section B: Strategic Management:

Objective: To understand the concepts of strategic management and techniques and the ability to apply the same in business situations.

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Introduction to Strategic Management | |

| Chapter 2: Strategic Analysis: External Environment | |

| Chapter 3: Strategic Analysis: Internal Environment | |

| Chapter 4: Strategic Choices | |

| Chapter 5: Strategy Implementation and Evaluation |

Must Check: Preparation Strategy for CA Intermediate Group 2 Papers.

CA Intermediate Preparations Tips Syllabus 2025

Understand the Syllabus and Pattern –

Aspirants Should Understand the CA Intermediate Syllabus. Students must first go through the complete syllabus before starting their preparation for the CA Intermediate exam.

Create a Study Schedule

Students should make a study plan for the CA intermediate exam in May 2025. With a perfect study plan, students can consistently focus on their studies and give proper time to every subject.

Practise Regularly

Students must regularly practise practical subjects like Accounts, Cost Accounting, and Taxation. These three Subjects contain most of the practical questions in the examination.

Time Management

CA Intermediate is the Second stage of the Chartered Accountant Course. The Syllabus for the Intermediate exam is very lengthy, and because of its vast syllabus, the paper is also very lengthy. Students have to manage their time properly. Without efficient time management, many students cannot complete the paper, and it will affect their results.

Concept Clarity –

Students have to revise their subject at least 2 to 3 times before the exam. Revision gives clarity over the concept and gives the power to remember the topic during the examination. You also have to work on concept clarity. Don’t memorise your subject; try to understand the topic or subject.

Practice Mock Test Papers

By practising Mock test Papers, Students get an idea of their strengths and weaknesses. Solving Mock test Papers allows students to identify their weak areas, which they can work on before exams. Mock test papers also give students an experience of the exam.

Can Students Crack CA Inter in 3 Months From New Scheme Syllabus

You will have three months to prepare for your exams. The students should set a target for every month and can then complete the entire syllabus of the CA intermediate course.

- Time hours to study: 12-15 hours daily

- Subjects to revise daily: Advanced Accounts, Cost accounting, Taxation (4 hours practical daily)

- Subjects to revise weekly: Law, Eco, Sm (fix one day of the week)

- Papers to revise fortnightly (15 days): Audit, Enterprise information system (Assign the number of hours to be devoted in each subject)

- Choose a proper studying place for yourself.

- The seat should be comfortable, and the room should have proper lights.

- Sit in a comfortable and erect position while studying.

- There should be no disturbance while you study.

- Make neat notes and use markers to underline important topics.

- Use the compilers of the updated syllabus.

First Month Study Plan for CA Intermediate May 2025

During the first month of preparation, try to cover the theoretical portion of the chapter. Keep working on the theoretical part of the subjects and try to understand the basic concepts so that things become easier for you for further studies. The course is vast so you need to be regular with your studies.

Second Month Study Plan for CA Intermediate May 2025

It’s time to practice practical problems for the entire day. With only one month left for exams, you need to cover the course in time with regular studies.

If you have any doubts, ask your teachers or seniors to help you. It is the time when your concepts about the subject should be clear and completely focused on a practical part of the course.

Sit back and concentrate on the topic you are efficient at, working to clear up any problems or dilemmas connected to that subject or question. You can again seek guidance from Teachers or your seniors.

CA Intermediate Third-Month Preparation Strategy

Eventually, you are here for the last 2 days for your exams. Your exams are approaching, so don’t stampede if you are still pending with the course. Adhere to your study plan, and you will surely be able to review those remaining topics.

Don´t be nervous or overconfident during this time. It is time to keep your mind and body stable and fit. With a focused and consistent study plan, you will be well-prepared and feel confident about your potential.

CA Intermediate New Syllabus Updates May 2025

ICAI has made changes in the CA Inter syllabus for the 2025 exams. ICAI has added some new topics and reduced some old topics from the ICAI syllabus. Given below are all the changes in the CA Syllabus done by ICAI for the 2025 examination.

Addition of Topics in the CA Intermediate Syllabus 2025

All the updates which are made by the ICAI for the May 2025 exam are mentioned below:

- Accounting topics of paper 1 have been shifted to paper 5, advanced accounting.

- ICAI has added the dissolution of partnership firms, including the piecemeal distribution of assets along with the conversion of partnership firms into companies and sales to companies, which is an issue related to accounting in limited liability partnerships.

Deduction of Topics in the CA Intermediate Syllabus

All the topics which are deducted from the CA Inter Syllabus for 2025 by the ICAI are mentioned below:

- Underwriting of shares and debentures.

- Valuation of goodwill.

- Application of Guidance Notes issued by the ICAI on specified accounting aspects.

- Financial Reporting of Insurance Companies and Mutual Funds and regulatory requirements thereof.

- Parties to notes, Bills and Cheques, Presentment of Negotiable Instruments, Payment and interest, and Noting and protest.

Students can check their CA Inter Result from this page.

CA Intermediate Exam Pattern

Check the CA Intermediate Exam Pattern for the May 2025 exams:

| Particulars | Details |

|---|---|

| Conducting Body | ICAI |

| Exam mode | Pen and Paper based |

| Types of question | Objective and subjective |

| Medium of exam | English and Hindi |

| Total no. of papers | 6 papers |

| No. of marks | 600 marks (100 per paper) |

| Negative marking | No negative marking |

Check out the complete CA Inter Date Sheet

To know more about the CA Intermediate Exam Pattern for May 2025, students can click on this link.

Due to the lengthy syllabus and difficult topics, passing the CA Inter exams is not easy. To clear the exams, VSI suggests that students complete the course soon, revise it at least two times, and practice with mock test papers regularly.

Therefore, 2-3 months are not enough to clear the CA Intermediate exams. It will take around 7 months.

This is all about the CA Intermediate syllabus for the May 2025 exams that you need to know. In this article, you’ve read about the syllabus and CA Inter subjects in detail, along with the marking scheme and updations in the CA Intermediate Syllabus 2025.

FAQ

Ques 1. How to download the CA Intermediate Syllabus 2025 PDF?

Ans. Students can download the PDF for the CA Inter new syllabus 2025 from the ICAI website. However, we have also mentioned the direct download link for the revised syllabus.

Ques 2. What are the CA Inter Group 1 subjects?

Ans. The CA Inter-group 1 subjects are:

- Advanced Accounting

- Corporate & Other Laws

- Taxation (Section A: Income Tax Law)

- Taxation (Section B: Goods and Service Tax)

Ques 3. What are the CA Inter Group 2 new subjects?

Ans. The CA Intermediate Group 2 new scheme subjects are: Cost and Management Accounting, Auditing and Ethics, Financial Management and Strategic Management ( Section A: Financial Management) ( Section B: Strategic Management)

Ques 4. When will ICAI issue the New Syllabus for May 2025?

Ans. The ICAI has released the CA Inter May 2025 New syllabus on its official website. Students can start their preparation by considering this CA Inter Study Plan to clear the CA Intermediate May 2025 exams on the first attempt.

Ques 5. Is the CA Inter Syllabus lengthy?

Ans. Yes, the syllabus of CA Inter is lengthy. However, if students start preparing for the exams early and properly manage their time, then they can easily complete their syllabus on time. Only then will they have enough time to revise and solve mock test papers.

Ques 6. Which group of CA Inter is easy to clear?

Ans. For those students who face difficulty in studying the theory subjects, group 1 will be easier for them as it has less theory portion.

Ques 7. Does CA Intermediate have Maths?

Ans. No, in the CA Intermediate course, there is no special subject in maths.

Ques 8. How many attempts are allowed in CA Intermediate Exams?

Ans. Chartered Accountancy students can take 8 attempts for CA Intermediate Exams. After that, they have to register for the CA Intermediate course again.