CA Final is the last stage of the CA course in India. After 2.5 years of Articleship in CA, final-level students are qualified to appear for CA’s last exams. The exams are held twice a year in May and November. Moreover, the last date for CA final registration is January 1st for the May attempt and July 1st for the November attempt. CA Final course has six papers divided into two groups to study.

Paper 4, Direct Tax and International Taxation, is in the Second group and is one of the most lengthy papers to cover.

Read how to get a rank in CA final exam. For guidance on the study and plan for CA final exams, we are providing you with an updated syllabus, study material, 30:70 MCQ, Judicial update, statutory update, RTP, MTP, Question papers and suggested answers, marks weightage chapter-wise and skill-wise, exam pattern and tips and tricks.

Students can master the international taxation subject regularly by solving the question paper, sample paper, mock test paper, and model test paper. Under the new course scheme, you can easily download all the study material for preparing the CA Final DT and International Taxation.

Students in CA final’s new revised course have the new and updated 30:70 assessment pattern for paper 4, International Taxation. The new syllabus has also introduced paper 4 as an elective and open-book paper. The elective paper is basically evaluated on students’ evaluation analytical and reporting skills. The exams are open-book exams for CA final 2025 paper 4.

Furthermore, ICAI has released the CA final exam date for the May 2025 exams. The Exam dates are 1st, 3rd, and 5th for group 1 and 7th, 9th and 11th for group 2 exam. Along with the Exam date ICAI has also released the CA Final Exam form to know the full details click the link.

Students can check the CA Final exam timetable for the May 2025 exams by clicking on this link.

CA Final Direct Tax Laws and International Taxation Paper 2025

CA Final Direct Tax Laws and International Taxation under the new course scheme is paper 7 of the CA final course under the new scheme.

Why should you study CA Final Direct Tax Laws and International Taxation paper?

We divide the syllabus into 2 groups. The direct tax syllabus of this course will help you to develop the acumen to analyse and interpret the different provisions of laws and apply them to find a solution. The other section of the paper is about getting expertise in understanding the different laws, provisions, and acts of International Taxation and then finding a solution for a business.

CA International Taxation /DT Paper Pattern 2025

- Paper pattern: 30:70 Assessment

- Total questions asked: 30 marks in MCQ and 5 questions in subjective pattern

- Total exam duration: 3 hours

- Maximum marks got: 100 marks (30:70)

CA Final International Taxation Assessment Pattern 2025

- -ICAI will assess each question through comprehensive knowledge, analytical skills, and reporting Skills

- -ICAI evaluates Paper 7 under the 30:70 assessment.

When students don’t follow the exam answer pattern, they get low marks and fail exams. Read tips for CA final failed students to learn more.

ICAI CA Final Paper 7 DT/ International Taxation Weightage 2023

ICAI has assigned weightage to specific chapters depending on their significance in the real world and their level of difficulty. It is important for students to plan and prepare for the exams according to the weightage of topics and break down chapters accordingly.

| Chapter | Topics | Weightage |

|---|---|---|

| Part 1 | Direct tax | |

| Chapter 1-12 | Chapter 1: Basic Concepts Chapter 2: Residence and Scope of Total Income Chapter 3: Incomes which do not form part of Total Income Chapter 4: Salaries Chapter 5: Income from House Property Chapter 6: Profits and Gains of Business or Profession Chapter 7: Capital Gains Chapter 8: Income from Other Sources Chapter 9: Income of Other Persons included in assessee’s Total Income Chapter 10: Aggregation of Income, Set-Off and Carry Forward of Losses Chapter 11: Deductions from Gross Total Income Chapter 12: Assessment of Various Entities | 35%-40% |

| Chapter 13-14 Chapter 22-23 | Chapter 13: Charitable or Religious Trusts and Institutions, Political Parties and Electoral Trusts Chapter 14: Tax Planning, Tax Avoidance & Tax Evasion Chapter 22: Liability in Special Cases Chapter 23: Miscellaneous Provisions | 5%-10% |

| Chapter- 15 | Chapter 15: Deduction, Collection and Recovery of Tax | 15%-20% |

| Chapter 16-21 | Chapter 16: Income-tax Authorities Chapter 17: Assessment Procedure Chapter 18: Appeals and Revision Chapter 19: Settlement of Tax Cases Chapter 20: Penalties Chapter 21: Offences and Prosecution | 15%-25% |

| Part 2 | International taxation | |

| Chapter 1-5 | Chapter 1: Transfer Pricing and Other Provisions to check Avoidance of Tax Chapter 2: Non-Resident Taxation Chapter 3: Double Taxation Relief Chapter 4: Advance Rulings Chapter 5: Equalisation Levy | 75%-85% |

| Chapter 6-8 | Chapter 6: Application and Interpretation of Tax Treaties Chapter 7: Fundamentals of Base Erosion and Profit Shifting Chapter 8: Overview of Model Tax Conventions | 15%-25% |

ICAI CA Final DT/ International Taxation Weightage: Skill Wise

Prepare for CA Final International Taxation/ Direct tax exams at 3 different levels.

For the CA Final 2025 exams, the first level makes notes of all the questions that can be asked as a list, define, describe, explain, recognize, identify, classify, and discuss. This type of question will assess your knowledge and comprehensive skills. These types of questions’ weightage in your exam paper will be 5%-10 for the direct tax and 15%-25% for the International taxation paper.

For the CA Final second-level assessment, practice the prescribed format of ICAI for application and analysis skills. Practice a lot of questions, having calculated, determined, solved, computed, and reconciled kinds of queries to excel in this skill. For Application and analytical skills, weightage in your marks will be around60%-80 for the direct tax and 75%-85% for the International taxation paper.

For the CA Final third-level assessment, practice the prescribed format of ICAI for evaluation and synthesis skills. Practice a lot of questions involving calculated, determined, solved, computed, and identified reconciled queries to excel in this skill. For evaluation and synthesis skills, weightage in your marks will be around 15%-20% for only the direct tax portion of the syllabus.

| Subject: Direct Tax (DT)and International Taxation(IT) | Nature of Questions | Weightage |

|---|---|---|

| Comprehension and Knowledge | Definition Describe the process Explain the concept Discussing a provision of law Listing the Condition Classify | DT:5%-10% IT:15%-25% |

| Application and Analytical | Computation/calculation/estimation Examining Issue Reconciling the statements Identifying the nature of income and expenditure Calculating profit and loss solving Problem by integrating the provision | DT:60%-80% IT:75%-85% |

| Evaluation and Synthesis | Compute income and profit and loss by assessing analysing and interpreting concepts and provision Interpretation of financial statement Evaluation of a proposal for assessing its validity Recommendation of a course of action | DT:15%-30% |

CA Final DT/International Taxation Syllabus for New Revised Course

ICAI has revised the CA Final syllabus under the new scheme. Students can download the entire CA Final Syllabus from here.

Free download of the updated syllabus of CA Final Direct Tax and International Taxation for the newly revised course from here.

CA Final DT/International Taxation Study Material 2025

Students can download CA Final Study Material 2025 for all subjects given by the Institute of Chartered Accountants of India from the link given here.

Study material includes the basic content of all the chapters included in the syllabus. We give the study material for paper 7 of the CA Final below. You can download and use it while preparing for exams.

Study Material for CA Final DT/International Taxation 2025

- Part I: Direct Tax Laws

- Module 1

- Initial Pages

- Chapter 1: Basic Concepts

- Chapter 2: Residence and Scope of Total Income

- Chapter 3: Incomes which do not form part of Total Income

- Chapter 4: Salaries

- Chapter 5: Income from House Property

- Chapter 6: Profits and Gains of Business or Profession

- Chapter 7: Capital Gains

- Chapter 8: Income from Other Sources

- Annexure

- Module 2

- Initial Pages

- Chapter 9: Income of Other Persons included in assessee’s Total Income

- Chapter 10: Aggregation of Income, Set-Off and Carry Forward of Losses

- Chapter 11: Deductions from Gross Total Income

- Chapter 12: Assessment of Various Entities

- Chapter 13: Charitable or Religious Trusts and Institutions, Political Parties and Electoral Trusts

- Chapter 14: Tax Planning, Tax Avoidance & Tax Evasion

- Module 3

- Initial Pages

- Chapter 15: Deduction, Collection and Recovery of Tax

- Chapter 16: Income-tax Authorities

- Chapter 17: Assessment Procedure

- Chapter 18: Appeals and Revision

- Chapter 19: Dispute Resolution

- Chapter 20: Penalties

- Chapter 21: Offences and Prosecution

- Chapter 22: Liability in Special Cases

- Chapter 23: Miscellaneous Provisions

- Module 1

- Part II: International Taxation

- Module 4

- Initial Pages

- Chapter 1: Transfer Pricing and Other Provisions to check Avoidance of Tax

- Chapter 2: Non-Resident Taxation

- Chapter 3: Double Taxation Relief

- Chapter 4: Advance Rulings

- Chapter 5: Equalisation Levy

- Chapter 6: Application and Interpretation of Tax Treaties

- Chapter 7: Fundamentals of Base Erosion and Profit Shifting

- Chapter 8: Overview of Model Tax Conventions

- Annexure

- Module 4

Students need the ICAI study material, along with some other books and notes available online and offline, to properly understand the topics. VSI gives the most sorted and simple CA final International taxation notes for a proper and deep understanding of the topics.

CA Final DT/International Taxation Question Papers with Suggested Answers 2025

By practising CA final papers of the previous year and interpreting them in a related pattern as suggested answers, the student gains the skills to give the answers in the format expected by ICAI, which encourages them to score good marks.

CA Final DT/International Taxation Mock Test Papers 2025

ICAI has amended the syllabus under the new scheme. Students can download the suggested Mock Test Paper for CA Final International Taxation for the new syllabus from here.

Series-I

Series-II

CA Final DT/International Taxation RTP 2025 for the Newly revised course

ICAI has improved the syllabus under the new scheme. Students can download the RTP of CA Final Strategic Financial Management for both Hindi and English medium students for 2018, 2019 and 2020 in May and November.

- May 2022 – Hindi Medium

- May 2022

- November, 2021 – Hindi Medium

- November 2021

- May 2021 – Hindi Medium

- May, 2021

- November 2020 – Hindi Medium

- November, 2020

- May 2020 – Hindi Medium

- May, 2020

- November 2019

- May 2019 – Hindi Medium

- May 2019

- November 2018 – Hindi Medium

- November 2018

- May 2018

CA Final DT/International Taxation 30:70 assessment MCQ for Practice 2025

More you practice, more chances of clearing exams with good marks. So we are sharing the 30:70 McQ for you to practice for your CA Final DT/ International Taxation 2025 Paper under the new revised scheme.

CA Final Direct Tax and International Taxation for Pen Drive and Online Classes

International Taxation needs constant practice to come through this subject. Students use the ICAI study material along with some other books and notes available online and offline to have a proper understanding of the topics. VSI provides the most sorted and simple study material for a proper and deep understanding of tax paper in their exclusive classes. They also provide pen drive classes to their students that cover the entire study material in the most effective way.

How to study for CA Final DT/ International Taxation 2025?

There are some regularly asked questions about how to study and what the study plan should be for the CA Final taxation paper. Read our article How to get a rank in the final exam to learn more.

Should I do self-study for CA final International Taxation, or should I enrol on CA coaching classes?

If you are well prepared with the syllabus and have the expert knowledge, comprehensive, analytical and application Skillset then you surely can build evaluation skills required at the final level with self-study. Else you can enroll with VSI for CA final coaching as:

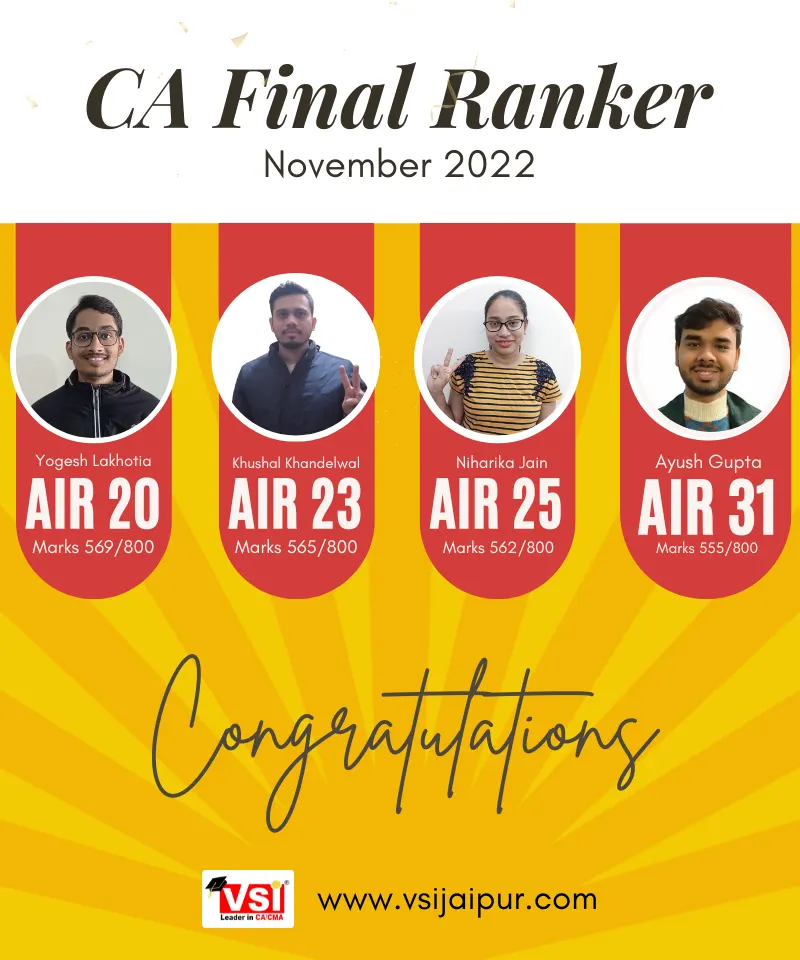

VSI gives the best Ca final results

They have the highest number of rankers

They have the highest number of toppers.

Are you still wondering