CA Intermediate is the second level of the CA Course. After clearing the CA Foundation Course, you’ll become eligible to register for the CA Intermediate Course. The level of the CA Intermediate Examination is hard to compare to the CA Foundation. Here, Students have to pass a total of 6 papers divided into 2 groups, 3 papers in each group.

In this guide, you’ll get complete details of the CA Intermediate course, including eligibility, registration, duration, syllabus, fees, exam form, preparation tips, books and more.

Student Who wants to know about the complete details of Chartered Accountant. Check this article CA Kaise Bane to know the full details of the CA Process.

CA Intermediate Course May 2025: Important Date

Check the table below to know the important date for the CA Intermediate Jan 2025 exams.

| Events | Dates |

|---|---|

| Last Date for registration for May 2025 | September 1, 2024 |

| May 2025 Exam Form Date | March 1 2025 – March 14 2025 |

| CA May 2025 Exam Dates | Group –I: May 03, 05, and 07, 2025 Group –II: May 9, 11 and 14, 2025 |

| Admit Card Release Date | 15 Days Before the Exams |

| CA Inter Result (May 2025) | Soon |

Register Now: CA Intermediate Classes

Eligibility for Registration in CA Intermediate Course

After clearing the CA Foundation exams, a candidate becomes eligible to register for the CA Intermediate course. Graduated or post-graduate students can also take the Direct Entry Route. In this scheme, a candidate can directly register for the CA Intermediate exam without going through the CA Foundation. To be eligible for the direct entry scheme.

- Students must clear their Graduation or Post Graduation in Commerce and secure a minimum of 55%.

- Non-commerce Graduates/ Post Graduates can register for Intermediate by securing 60% marks.

- Students who cleared the Intermediate level of the Institute of Cost Accountants of India or The Institute of Company Secretaries of India.

- Students appearing for the final year exams of graduation can apply under the provisional scheme.

The above students are eligible to register directly for the Intermediate level without passing the CA Foundation.

Complete CA Intermediate Course Journey for May 2025 Exams

Below is the complete CA Inter course journey you will be going through in the next few months. You’ll get all the details from eligibility for registration to checking the results in brief.

Below is the complete CA Inter course journey you will be going through in the next few months. You’ll get all the details from eligibility for registration to checking the results in brief.

1. Eligibility – After clearing the CA foundation exams, students are eligible to register for the CA Intermediate exams. Through the Direct entry route, graduate students can directly enrol in the CA Intermediate Course and skip the Foundation exams.

2. Registration—Eligible students can register for the CA Intercourse by filling out the form online. Your registration will be completed when you pay the registration fees.

3. Preparation – You’ll get a study period of 8 months to prepare for the exams. You have to prepare for 8 subjects if you give both groups together. Students can also prepare for a single group.

4. Exam Form—Students can fill out the CA Intermediate exam form for May 2025 in March 2025. The exam form fee for CA Intermediate is Rs. 2700 for both groups and Rs. 1500 for a single group.

5. Admit Card – ICAI releases the admit card 14 days before the examination. You can directly download your admit card from the official ICAI website.

6. Error Correction – Sometimes, students fill in incorrect information on their admit cards. Therefore, ICAI opens two correction windows to rectify the errors in the admit card, if any.

7. Exams – The CA Intermediate exams of May 2025 will be conducted in the first and second week of May.

8. Result – ICAI declares the CA Intermediate results two months after the exam. To clear the CA Intermediate exams, candidates need to get more than 40% in each subject or 50% aggregate.

Also Check: How to Become CA (Complete Guide)

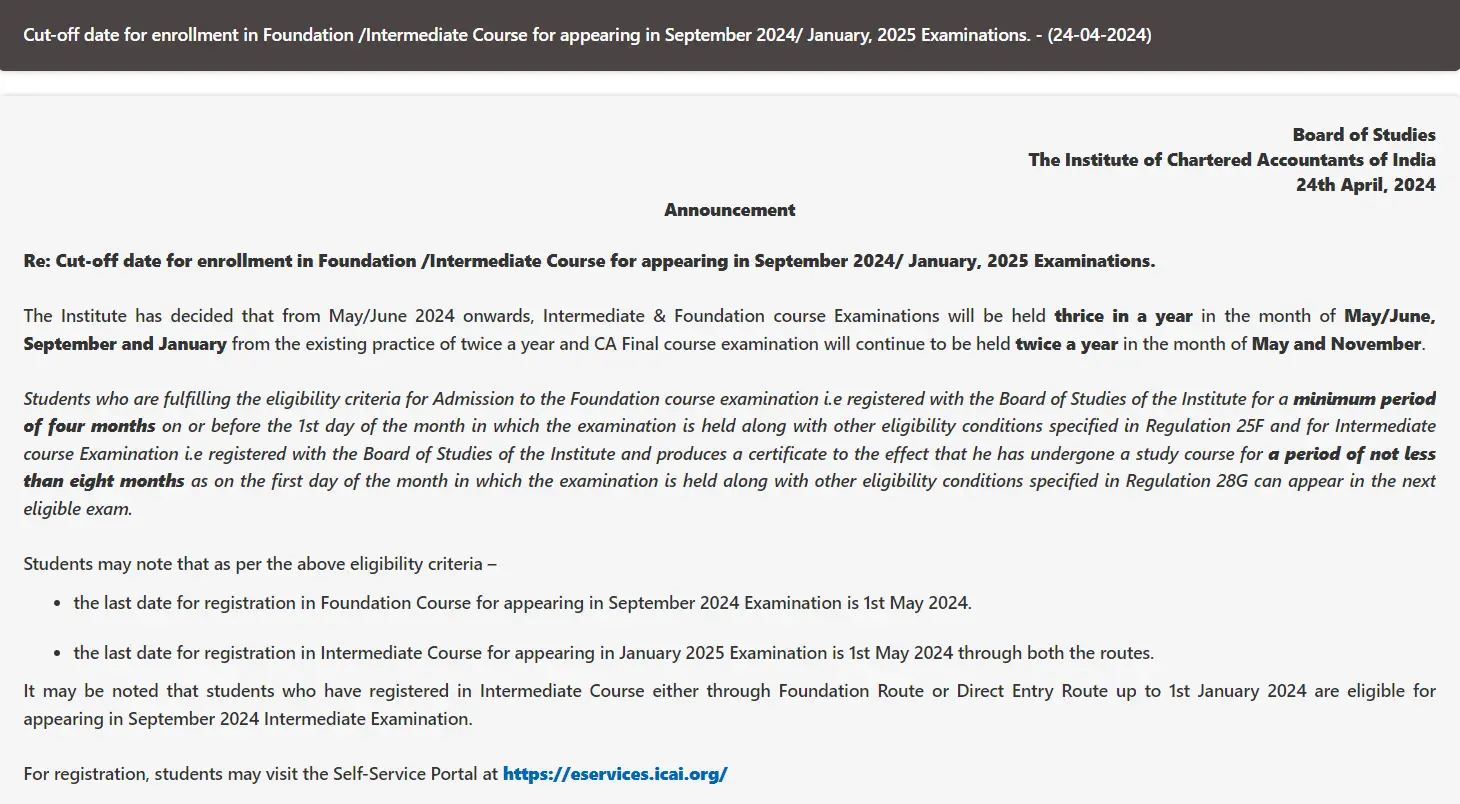

CA Intermediate Exam Thrice in a Year

According to the ICAI Notification, the Cut-off date for enrollment in the Intermediate Course for appearing in the Jan 2025/ May 2025 Examinations is.

The Institute has decided that from May/June 2024 onwards, Intermediate course Examinations will be held thrice a year in May/June, September, and January instead of twice a year.

Students who fulfil the eligibility criteria for Admission to the Intermediate course Examination, i.e registered with the Board of Studies of the Institute and produce a certificate to the effect that he has undergone a study course for a period of not less than eight months as on the first day of the month in which the examination is held along with other eligibility conditions specified in Regulation 28G can appear in the next eligible exam.

Students may note that as per the above eligibility criteria –

The last date for registration in the Intermediate Course for appearing in the May 2025 Examination was September 2024 through both routes.

Check all the details about the CA Inter exam dates in our comprehensive article.

How to Register for CA Intermediate

A student can register for the CA Intermediate course by filling out the registration form online and paying the requisite fees. After the payment, the system will automatically generate the registration form.

The printout of such online registration form is required to be submitted to the concerned regional office duly signed by the candidate along with the following documents:

Document Required for CA Intermediate Registration:

- For foundation route students, submit the attested copy of the mark sheet of class 12th or its equivalent Central Govt. recognized examination pass mark statement.

- For direct-entry route students, submit an attested copy of the Graduation / Post Graduation Marksheet OR Marksheet or Mark statement of Intermediate level Examination of ICSI (Institute of Company Secretaries of India) or ICWAI (Institute of Cost Accountants of India).

- Affix a coloured and latest photograph on the hard copy of the registration form.

- Attested copy of the proof of Nationality if the student is a foreigner.

- Attested copy of the proof of special category certificate, i.e. SC/ST/OBC or Differently abled.

How to fill out the CA Intermediate Registration Form?

- Visit the ICAI website or click on the given link: www.icai.org

- Log in to the self-service portal using the email ID and password.

- After authentication, go to the Student SSP portal.

- Then, choose the student cycle(CA foundation or direct entry).

- Fill in the required details and click on “save and next”.

- You’ll receive the OTP, which will complete your login process. Now, login and fill in the additional details.

- Lastly, you have to pay the registration fees online.

Check out the detailed version of the steps mentioned above for filling out the CA Intermediate registration form.

After completing the formalities mentioned above, ICAI CA Inter study material will be dispatched to the students within one month through the Centralized Dispatch System. Students can also check the CA Intermediate Exam Pattern and Marking Scheme.

After completing your CA Intermediate registration, you should start preparing for the exams. Prepare a study plan for yourself and complete the CA syllabus on time. It will help you in doing three times revisions and you can also practice the CA Intermediate papers.

Validity Period of CA Intermediate Registration

The CA Intermediate registration is valid for 4 years. It can be revalidated for a further 4 years by paying a revalidation fee of Rs. 400/—or as decided by the Council from time to time.

Students can also read about the total CA Course duration and learn how many years it takes to become a CA.

CA Intermediate Exam Form for May

Apart from the registration form, students also have to fill out the exam form for the CA Intermediate course. They can fill out their CA Intermediate exam form through the ICAI website. If the candidate is registered, he can directly log in to their account and fill out the application form.

However, a new user must register first for the Intermediate course. Students can fill out the CA Inter exam form for May 2025 when the forms are released by ICAI, on March 1, 2025 to March 14, 2025. After filling out the CA Intermediate Exam form, you need to pay the requisite amount.

Hindi-medium students can check this link – CA Intermediate Exam form in Hindi.

CA Intermediate Course Fees

The total CA Intermediate Course fee is Rs. 20,700 for both groups and Rs. 14,500 for a single group. For foreign students, the fee is $1500 for both groups and $925 for a single group.

Check the table below to know the complete CA Inter Course fees:

| Details of Fees | Both Groups (Rs) | Single Group (Rs) | Both Groups ($) | Single Group ($) |

| CA Intermediate Registration Fees | Rs. 15000 | Rs. 11000 | $ 1000 | $ 600 |

| Student’s Activity Fees for CA Intermediate | Rs. 2000 | Rs. 2000* | ||

| CA Intermediate Registration Fees (as article assistant) | Rs. 1000 | |||

| CA Intermediate Exam Form | Rs. 2700 | Rs. 1500 | $500 | $325 |

| Total CA Intermediate Fees | Rs. 20700 | Rs. 14500 | $1500 | $925 |

Direct entry route students have to pay Rs. 200 as the cost of a prospectus in addition to the above fees. Moreover, foreign students have to pay registration fees of $1000 for both groups and $600 for a single group.

Furthermore, Direct entry students must also register for the ITT and OP training programs before registering for the practical training, each lasting 15 days. The fee for the ITT(Information Technology Training) Program is Rs 6500/—and for the OP (Orientation Program ) is Rs 7000/—, inclusive of the study material and tea/refreshments provided by the ICAI.

To know the complete details about the CA Intermediate Fee, visit the following page.

Correction Window for May 2025

ICAI provides 2 correction windows for rectifying errors in case incorrect details are submitted in the exam form. The first correction window is free, and the second correction window requires a fee of Rs. 1000/—per application. The CA Intermediate May 2025 correction window starts from March 18 to 20, 2025

- Correction Window 1– Under this, a student can change their Center/Medium for free within one week after the last date of submission of the Examination form (without late fees).

- Correction Window 2 (with fees)– Under this window, a student can change his/her Center/Medium with the payment of Rs. 1000/- per application. Generally, this window is open for correction up to one week before the exam. But requests made immediately before 7 days will not be entertained by the ICAI in any case.

CA Intermediate Syllabus and Subjects 2025

There are 6 papers in the CA Intermediate syllabus, divided into 2 groups of 3 papers each.

CA Intermediate New Scheme Syllabus for May 2025 Exam –

Paper 1: Advanced Accounting (100 Marks)

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Introduction to Accounting Standards | |

| Chapter 2: Framework for Preparation and Presentation of Financial Statements | |

| Chapter 3: Applicability of Accounting Standards | |

Chapter 4: Presentation and Disclosures Based Accounting Standards

| |

Module-2 | |

Chapter 5: Assets Based Accounting Standards

| |

Chapter 6: Liabilities Based Accounting Standards

| |

Chapter 7: Accounting Standards Based on Items Impacting Financial Statement

| |

Chapter 8: Revenue Based Accounting Standards

| |

Chapter 9: Other Accounting Standards

| |

Chapter 10: Accounting Standards for Consolidated Financial Statement

| |

Module-3 | |

Chapter 11: Financial Statements of Companies

| |

| Chapter 12: Buyback of Securities | |

| Chapter 13: Amalgamation of Companies | |

| Chapter 14: Accounting for Reconstruction of Companies | |

| Chapter 15: Accounting for Branches including Foreign Branches |

Paper 2: Corporate and Other Laws (100 Marks)

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Preliminary | |

| Chapter 2: Incorporation of Company and Matters Incidental Thereto | |

| Chapter 3: Prospectus and Allotment of Securities | |

| Chapter 4: Share Capital and Debentures | |

| Chapter 5: Acceptance of Deposits by Companies | |

| Chapter 6: Registration of Charges | |

Module-2 | |

| Chapter 7: Management & Administration | |

| Chapter 8: Declaration and Payment of Dividend | |

| Chapter 9: Accounts of Companies | |

| Chapter 10: Audit and Auditors | |

| Chapter 11: Companies Incorporated Outside India | |

Module-3 | Chapter 12: The Limited Liability Partnership Act, 2008 |

Module-3 (Part-II Other Laws) | |

| Chapter 1: The General Clauses Act, 1897 | |

| Chapter 2: Interpretation of Statutes | |

| Chapter 3: The Foreign Exchange Management Act, 1999 |

Paper 3: Taxation (100 Marks)

Section A: Income Tax Law (50 Marks)

Syllabus Modules | Chapters |

Module-1 | |

| Section I Chapter 1: Basic Concepts Chapter 2: Residence and Scope of Total Income | |

| Section II Chapter 3: Heads of Income | |

Module-2 | |

| Section III Chapter 4: Income of Other Persons included in Assessee’s Total Income Chapter 5: Aggregation of Income, Set-Off and Carry Forward of Losses Chapter 6: Deductions from Gross Total Income | |

| Section IV Chapter 7: Advance Tax, Tax Deduction at Source and Tax Collection at Source Chapter 8: Provisions for filing Return of Income and Self Assessment | |

| Section V Chapter 9: Income Tax Liability – Computation and Optimisation |

Section B: Goods and Service Tax (50 Marks)

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: GST in India – An Introduction | |

| Chapter 2: Supply under GST | |

| Chapter 3: Charge of GST | |

| Chapter 4: Place of Supply | |

| Chapter 5: Exemptions from GST | |

| Chapter 6: Time of Supply | |

| Chapter 7: Value of Supply | |

Module-2 | |

| Chapter 8: Input Tax Credit | |

| Chapter 9: Registration | |

| Chapter 10: Tax Invoice; Credit and Debit Notes | |

| Chapter 11: Accounts and Records | |

| Chapter 12: E-Way Bill | |

| Chapter 13: Payment of Tax | |

| Chapter 14: Tax Deduction at Source and Collection of Tax at Source | |

| Chapter 15: Returns |

Paper 4: Cost and Management Accounting (100 Marks)

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Introduction to Cost and Management Accounting | |

| Chapter 2: Material Cost | |

| Chapter 3: Employee Cost and Direct Expenses | |

| Chapter 4: Overheads – Absorption Costing Method | |

| Chapter 5: Activity Based Costing | |

| Chapter 6: Cost Sheet | |

| Chapter 7: Cost Accounting Systems | |

Module-2 | |

| Chapter 8: Unit and Batch Costing | |

| Chapter 9: Job Costing | |

| Chapter 10: Process and Operation Costing | |

| Chapter 11: Joint Products and By Products | |

| Chapter 12: Service Costing | |

| Chapter 13: Standard Costing | |

| Chapter 14: Marginal Costing | |

| Chapter 15: Budgets and Budgetary Control |

Paper 5: Auditing and Ethics (100 Marks)

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Nature, Objective and Scope of Audit | |

| Chapter 2: Audit Strategy, Audit Planning and Audit Programme | |

| Chapter 3: Risk Assessment and Internal Control | |

| Chapter 4: Audit Evidence | |

| Chapter 5: Audit of Items of Financial Statements | |

Module-2 | |

| Chapter 6: Audit Documentation | |

| Chapter 7: Completion and Review | |

| Chapter 8: Audit Report | |

| Chapter 9: Special Features of Audit of Different Type of Entities | |

| Chapter 10: Audit of Banks | |

| Chapter 11: Ethics and Terms of Audit Engagements |

Paper 6: Financial Management and Strategic Management (100 Marks)

Section A: Financial Management (50 Marks)

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Scope and Objectives of Financial Management | |

| Chapter 2: Types of Financing | |

| Chapter 3: Financial Analysis and Planning – Ratio Analysis | |

| Chapter 4: Cost of Capital | |

| Chapter 5: Financing Decisions – Capital Structure | |

| Chapter 6: Financing Decisions – Leverages | |

Module-2 | |

| Chapter 7: Investment Decisions | |

| Chapter 8: Dividend Decision | |

| Chapter 9: Management of Working Capital |

Section B: Strategic Management (50 Marks)

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Introduction to Strategic Management | |

| Chapter 2: Strategic Analysis: External Environment | |

| Chapter 3: Strategic Analysis: Internal Environment | |

| Chapter 4: Strategic Choices | |

| Chapter 5: Strategy Implementation and Evaluation |

Must Check: All information regarding CA exams.

CA Intermediate Books for 2025 Exams

Check out the CA Intermediate Books that you should prefer for preparing for the 2025 exams:

- First Lessons in Accounting by M.P. Vijay Kumar.

- Padhuka’s Handbook on Taxation by G Sekar.

- Bestword’s Auditing & Assurance by Surbhi Bansal.

- Taxmann’s Auditing and Assurance by Pankaj Garg.

- Students Guide for Enterprise Information Systems & Strategic Management by G Sekar.

Students can check out our article to learn more helpful books for the CA Intermediate preparation.

How to Prepare for CA Intermediate 2025

To prepare well for the CA Intermediate Exams, the most important thing is to dedicate yourself to your studies and follow a proper study plan. So, check these detailed articles regarding the study plan for CA Inter Group 1 and 2 subjects:

To score good marks in your exams, you also need to prepare with the mock test papers and Intermediate previous year papers. Solving these papers will give you confidence, and you can also learn about time management.

The above resources will help you in exam preparation, but to become a CA Topper, you must follow these success mantras of CA Toppers and have a unique study plan.

As you know, ICAI permits the use of a calculator in CA exams, you must learn these quick tricks to use calculators and save your exam time.

CA Intermediate Admit Card 2025

ICAI generally issues admit cards 14 days before the exams. ICAI issued the CA Intermediate Admit card for the May 2025 exam on April 16, 2025 (tentatively). Students can download the CA Inter May 2025 admit card from the official website. Admit cards will not be sent offline; the only way is to download them through the ICAI website.

Details you should check on the CA Intermediate Admit Card are:

- Name of the Candidate

- Candidate’s Photograph and Signature

- Name of the Examination Centre

- Roll Number

- Groups enrolled

- Examination City

- Medium of Examination

- Candidate’s Address

- Exam day instructions for candidates

CA Intermediate Result 2025

ICAI declares the CA Intermediate result two months after the exam. The CA Inter May 2025 result will be declared on July 11th 2025.

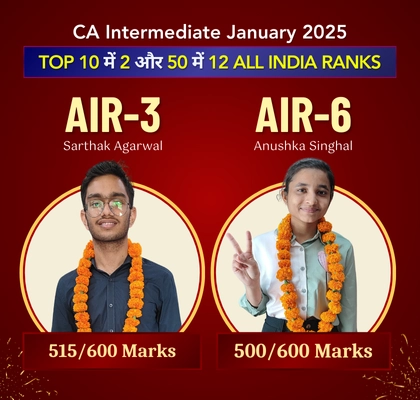

CA Intermediate Passing Percentage Jan 2025: Of the 1,08,187 candidates appearing in the CA group 1 inter exam, as many as 15,332 (14.17 per cent) have qualified. In CA Inter group 2, a total of 80,368 candidates appeared for the exam and of them, 17,813 passed (22.16 per cent). As many as 48,261 candidates appeared for both groups and only 6,781 (14.05 per cent) passed.

CA Intermediate Toppers September 2024: The AIR 1 Kushagra Roy from Bhiwadi has obtained 538 marks (89.67 per cent). Two candidates have obtained AIR 2 — Yuj Sachin Kariya from Akola and Yogya Lalit Chandak from Bhayandar. They have scored 526 marks (87.67 per cent). AIR 3 as well is shared by two candidates — Manjit Singh Bhatia from New Delhi and Hiresh Kashiramka from Mumbai. They have scored 519 marks (86.50 per cent).

As per the ICAI guidelines, a candidate shall be declared to have passed the CA Intermediate course if he scores a minimum of 40% marks in each individual subject and 50% marks in the aggregate of all the subjects in one sitting, either in both groups or a single group.

Furthermore, ICAI will most likely release the CA Final Result May 2025 on 11th July 2025. Along with the result, ICAI also releases the CA Inter Pass Percentage or CA Inter Toppers list. You can check the result directly from the link mentioned.

CA Intermediate: Training Details ( ICITSS, Articleship, AICITSS and Industrial)

After clearing either one group or both of the CA Intermediate Exams, a student has to undergo some practical training in CA course as directed by ICAI.

- ICITSS Training

The training consists of an Information Technology (IT) and Orientation Course (OC) each of 15 days (6 hours each day). The fees for such IT (Information Technology) course shall be Rs 6500/- and the fee for OP (Orientation Program) is Rs 7000/- per student, including course material and tea refreshments. - ARTICLESHIP Training

Students pursuing the Chartered Accountancy course must be aware of the three years of CA Articleship training. The motto behind such three years of practical training is to prepare a CA Student into an experienced, knowledgeable, and well-rounded professional. - AICITSS Training

AICITSS stands for Advanced Integrated Course on Information Technology and Soft Skills which consists of Advanced Information Technology and Management and Communication Skills each of 15 days. The fee for Advanced Information technology training is Rs 7500/- and for Management and Communication Skills is Rs 7000/- per student inclusive of course material and tea refreshments. - INDUSTRIAL Training(optional)

Industrial Training in CA Course is completely optional for the students pursuing Chartered Accountancy. The objective of Industrial Training is to provide industries with Chartered Accountants who possess adequate knowledge and background of industrial functioning, conceived the concepts of industrial training.

About VSI CA Intermediate Coaching

VSI Jaipur is the best CA Intermediate coaching that helps students get AIR in CA Intermediate exams. Our 7 students got All India 1st Rank in the last 10 years in CA exams.

Further, our experienced faculty provides offline and online classes for CA intermediate exams with a result-oriented approach. This approach helps students pass CA inter exams on the first attempt.

If you want to clear the CA Intermediate level in the first attempt with AIR, then you must consider our CA intermediate classes for your next attempt.

FAQs

Ques 1. What is the CA Intermediate Course?

Ans. CA Intermediate is the second level of the CA course. There are 6 subjects in the CA Intermediate course that cover in-depth knowledge of Accounting, Finance, and Auditing.

Ques 2. What is the duration of the CA Intermediate Course?

Ans. The duration of the CA Intermediate is around 8 months, including the waiting period for the result.

Ques 3. What is the time gap between CA Foundation and CA Intermediate?

Ans. The time gap between CA Foundation and CA Intermediate is 8 to 10 months.

Ques 4. When are the CA Intermediate Results announced?

Ans. CA Intermediate Results are announced two months after the last date of the exam.

Ques 5. What are the ICAI exemption rules in CA Exams?

Ans. ICAI has allowed some exemption rules in the passing criteria of CA Exams. However, they apply to certain conditions only. Our article on understanding ICAI CA Exemptions explains all the conditions in detail.

Ques 6. How many subjects are there in the CA Intermediate course?

Ans. There are a total of 6 subjects in CA Intermediate. The subjects are categorized into 2 groups. Students must complete these subjects in 6 months to prepare for the exams.

Ques 7. What are the subjects in CA Intermediate?

Ans. In the CA Intermediate Exam, there are 6 Subjects:

- Advanced Accounting

- Corporate and Other Laws

- Taxation

- Cost and Management Accounting

- Auditing and Ethics

- Financial Management and Static Management

Ques 8. Who is eligible for CA Inter?

Ans. Candidates who have qualified CA Foundation exam. One can also enrol for the CA Intermediate course through a direct entry scheme.

Ques 9. Is CA Intermediate easy?

Ans. CA Intermediate is not hard to think of. If students prepare for CA Intermediate consistently and with proper guidance, they can pass the CA Intermediate Exam in a Single attempt. VSI Jaipur proved this many times by giving AIR Rank 1 of 5 Students in a Single attempt.