Chartered Accountants are among the highest-paid professionals in India, and their salaries are in lakhs. The primary reason for the high salary of a CA in India is the growth in the financial sector, which increased the demands and jobs of CAs.

The average salary of a CA in India is Rs. 9.0 lakhs per annum, ranging from 3.6 lakhs to 12 lakhs per annum. Moreover, the highest annual packages of a Chartered Accountant can reach up to 60-80 lakhs Per Annum as per their skills and experience.

The Big 4 companies and MNCs in India are among the biggest employers of CA. Moreover, CAs working outside India can earn handsome packages of up to INR 70 to 80 lakhs pa.

In this article, you’ll know the Chartered Accountant’s salary and the major factors that affect it, such as experience, skills, job profile and location.

Furthermore, to earn high perks of money, a lot of hard work and discipline are required. You will also need good CA articleship experience and clear the CA exams on the first attempt with an AIR. So, if you’re interested in accounting, taxation, and finances, Chartered Accountancy is an excellent and high-income career for you.

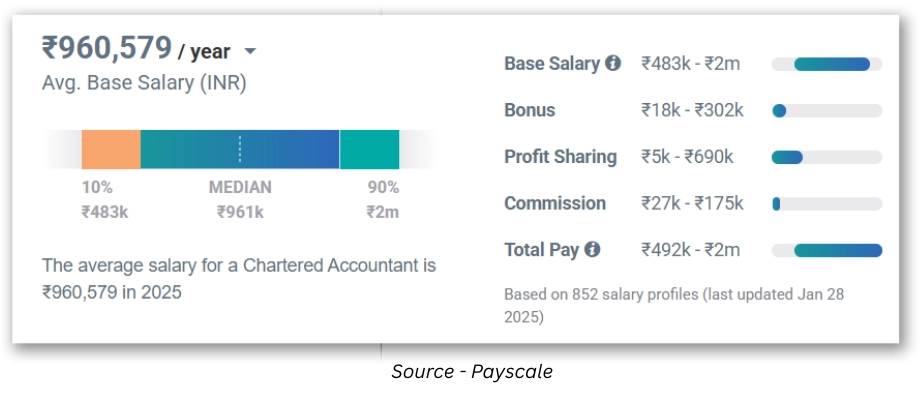

Chartered Accountant Salary in India 2025:-

Based on the ICAI Report 2025, the average CA salary in India is between Rs. 8 – 9 lakhs per annum and can go up to Rs. 50 – 60 lakhs.

- CA Salary in India per month – Rs. 37,000.

- Starting Salary of a Chartered Accountant – INR 8-9 Lakhs pa.

- Salary of a CA Topper (Fresher) – INR 25 lakhs.

- Highest Salary of CA in India – Rs. 60 Lakhs per annum.

- Annual CA Package in India after 10 years – INR 30 lakhs.

Read in Hindi: CA ki Salary

Chartered Accountant Salary in India 2025

Check out the average salary of a Chartered Accountant in India in the table below:

| Particulars | Per Annum Salary | Monthly Salary |

| Average Salary for Freshers | INR 3.5 Lakh P/A | 29,000 P/M |

| Lowest salary | INR 2.5 to 3.0 Lakh P/A | INR 20000 – 23000 P/M |

| Experienced (2-3 yrs) | INR 5 to 7 Lakh P/A | INR 41000 – 58000 P/M |

| Highest Salary | INR 60 to 70 Lakh P/A | INR 5,00,000 to 5,80,000 Lakh P/M |

| CA final Rankers Salary | INR 15 to 25 Lakh P/A | INR 125000 to 200000 Lakh P/M |

Also Check: CMA Salary in India

Starting Salary of CA in India per Month

The CA starting salary in India is around INR 37,000 per month. Moreover, the CA monthly Salary will depend on his rank in CA Final, articleship experience, job role, and the company in which he is working. Furthermore, fresher CAs who have cleared the exams in the first attempt get higher salary packages of INR 12- 13 lakhs per annum. Moreover, the salary provided to a CA topper in India is INR 15 to 20 Lakhs per annum.

| Particulars | Salary |

| CA Final cleared in many attempts | INR 8-9 Lakhs |

| CA Final cleared in 1st attempt | INR 12-13 Lakhs |

| CA Final Toppers | INR 15-25 Lakhs |

In Addition, you learn about the entire CA course. Click on this article to learn the complete details about the CA Course guide.

Minimum Salary Package of a Fresher Chartered Accountant in India

The minimum package of a fresher Chartered Accountant in India is around INR 2.5 to 3 lakhs per annum. Generally, candidates who have cleared the CA exams in multiple attempts will get these low packages. But with consistent efforts and good performance, they can get a better salary in the long run. However, we suggest you work harder and clear the CA exams on the first attempt and get a high salary.

Highest Per Month Salary of a CA in India

The highest salary of a fresher CA in India is 2-2.5 lakhs per month. It is offered to candidates who top the CA exams with an All India Rank. After getting experience and expertise, Chartered Accountants can earn up to 5 lakhs per month. However, foreign companies also employ CAs from India and pay them up to INR 76 lakhs per annum in exchange for their services. Furthermore, many chartered Accountants have their own businesses and are earning crores.

Also Read: CA Course Duration

CA Salary Comparison Between India & Other Countries

The salary given to Chartered accountants differs according to the country he is working in. There are higher demands for CA in certain countries than in others. Furthermore, the salary packages also depend on the standard of living, human resource value, financial sector, and the size of businesses.

Check the below comparison table of CA salary in India vs other countries:

| Country | Fresher | Experience(4-5 yrs) | Lowest Salary | Highest Salary | Average Salary |

| India | INR 698.3k | INR 1000k | INR 437k | INR 7M | INR 804.3k |

| USA | $51.1k | $78.7k | $28k | $267k | $80k |

| Dubai | AED 100k | AED 121k | AED 27k | AED 616k | AED 119k |

| UK | £28.4k | £32.2k | £24k | £62k | £ 35.9k |

| Australia | AU$ 74.1k | AU$64.1k | AU$54k | AU$113k | AU$ 70.9 |

Chartered Accountant Salary Offered by Different Sectors in India 2025

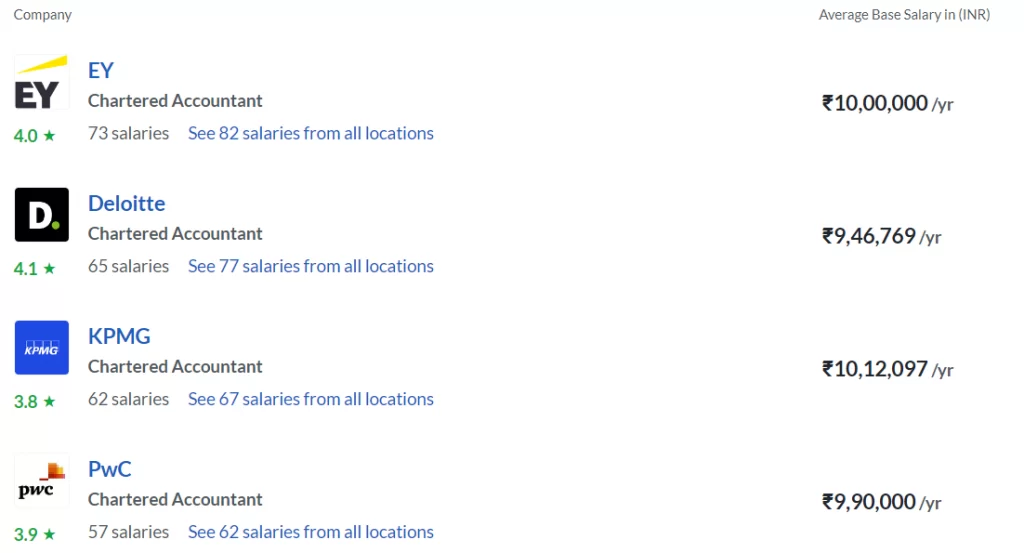

The Big 4 CA Firms

The Big 4 defines the four most extensive accounting firm networks. It consists of E&Y, PWC, Deloitte, and KPMG. The Big 4 firms are among the biggest employers and pay high CA salaries in India. Thousands of students work really hard to get a job in the Big 4 firms.

In Addition, the average CA salary paid by these big 4 firms ranges from INR 6-8 lakhs per annum for freshers. However, after acquiring experience and knowledge, these firms offer up to INR 25 lakhs per annum to a Chartered Accountant, depending on his capability and skill.

Salary of fresher Chartered Accountants in the Big 4 firms:

| Big 4 Firm | Least Salary | Highest Salary |

| Deloitte LLP | INR 45,000 | INR 60,000 |

| PricewaterhouseCoopers | INR 48,000 | INR 68,000 |

| Ernst & Young | INR 40,000 | INR 63,000 |

| KPMG | INR 46,000 | INR 62,000 |

CA Salary in Multi-National Companies and FMCGs

Multinational and FMCG companies offer a starting CA salary of 18-25 lacs per annum. To get a job in multinational companies such as HUL, P&G, RB, and Marico, you need to get an AIR under 50 as they hire only ranked students.

In addition to an attractive Chartered Accountant salary, you’ll receive perks and financial benefits like free conveyance, a leased car, accommodation, insurance, and more.

Salary of CA Firms

The salary offered by top CA Firms generally ranges between INR 3-8 lacs per annum. After all, Joining a CA firm in the initial years will give you great exposure and work experience. Here, a fresher Chartered Accountant learns how to deal with clients or income tax officers. Later, you can start your own practice and can earn higher perks of money.

CA Salary in IT Companies

The salary offered by IT companies to the fresher Chartered accountants ranges from INR 8 to 10 lakhs per annum, and the experienced accountants will get around INR 50-60 lakhs per annum. Furthermore, IT Companies like TCS, Wipro, and Infosys are best for CAs who don’t want an extra workload. In these companies, CAs enjoy a good job with a handsome package and less workload. Also, the work is to increase profit and reduce losses by using their analytical skills and knowledge. However, being an enthusiastic Chartered Accountant is often not preferred as it will not upgrade your knowledge and expertise.

CA Salary in Public Sector Undertakings

The CA salary offered by PSUs ranges between INR 7-15 Lacs per annum. However, the annual increment is very limited, but it is still a good option. In addition, Government companies or PSUs like BSNL, ONGC, BHEL, and GAIL hire many fresher CAs from the ICAI campus placement, and these companies often shortlist the candidates based on their marks ranging from 55% to 60%.

Chartered Accountant Salary in Banks

Indian banks such as ICICI, HDFC, SBI, PNB, and others offer CAs an annual package of INR 8 to 10 per annum. Furthermore, in the banking sector, there are various job roles available for Chartered Accountants, such as Analyst, Financial officer, Audit executive, etc.

CA Salary in Manufacturing Companies

The annual Chartered Accountant salary offered by Manufacturing companies such as TCS and MRF ranges between INR 7 to 8 lakhs per annum. The initial packages are low, but the growth and increments are high.

4 Factors Affecting CA Salary Packages in India

Many factors affect how much a CA will earn and play a major role in determining their payslip. These factors are experience, skills, job profiles, the city in which they live, etc.

CA Salary in India Based on Experience

Companies, when recruiting a Chartered Accountant, value experience in terms of the number of years and knowledge. The work performed by the CA in those years will impact his annual package.

In general, the CA salary in India is INR 20 lakhs pa for candidates with 5 years’ experience.

| CA Experience | Per Annum Salary |

| 0-5 years | INR 10-15 lakhs |

| CA salary after 10 years | INR 23 lakhs |

| 10-20 years | INR 30 lakhs |

| Above 20 years | INR 50-70 lakhs |

Therefore, CAS must upgrade its knowledge of higher pay packages.

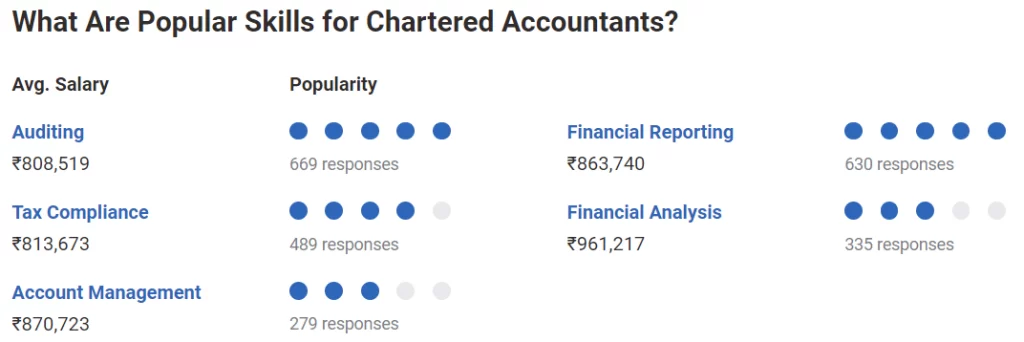

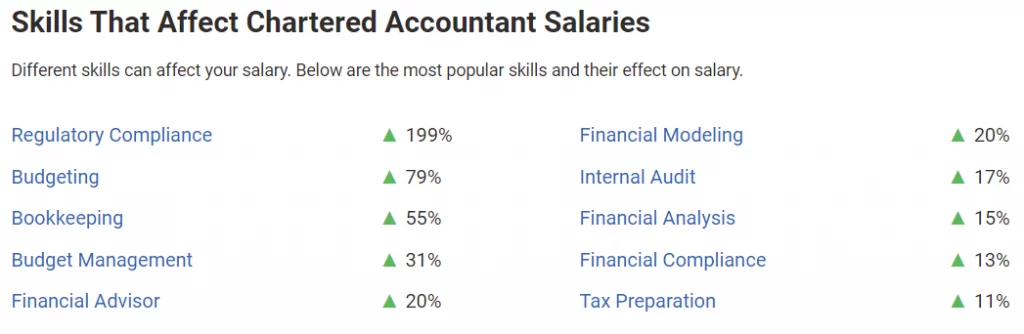

Chartered Accountant Salary Based on Skills

If a CA has analytical, compliance, and reporting skills, he will get a higher salary than others. Furthermore, a CA with hard skills like budget management, strategic accounting, management auditing, financial analysis, and controlling gets an average remuneration of more than INR 8 lakhs. Below is the table showing Chartered Accountants’ salaries in India based on their skills.

| CA Skills | Per Annum Salary |

| Budget management | INR 9.5-11 lakhs |

| Strategic accounts | INR 8.9-9 lakhs |

| Evaluation and management auditing | INR 8.5-9 lakhs |

| Financial analysis | INR 8.5-8.8 lakhs |

| Financial advisor | INR 8.5-8.75 lakhs |

| SAP financial accounting and controlling | INR 8.10-8.25 lakhs |

| Financial reporting | INR 8.-8.2 lakhs |

| Auditing | INR 7-7.5 lakhs |

| Account management | INR 7-7.25 lakhs |

| Internal audit | INR 7.25-7.35 lakhs |

| Accounting | INR 7.25-7.35 lakhs |

| Tax consulting | INR 7.10-7.25 lakhs |

| Tax compliance | INR 7-7.1 lakhs |

Also, Check Courses After B.COM to Enhance additional Skills as a CA.

CA Salary in Different Job Profiles

A CA has vast knowledge in various fields of finances and taxes and thus has a lot of job opportunities. He can go for Financial officer, Accountant, Finance Manager or Business Analyst.

Given below is the list of Chartered accountant salaries based on their work profiles.

| CA Job Profile | Per Annum Salary |

| Financial officer | INR 35 lakhs |

| Account executive | INR 25 lakhs |

| Accountant | INR 25 lakhs |

| Finance controller | INR 19 lakhs |

| Finance manager | INR 10 lakhs |

| Chartered accountant | INR 7.25 lakhs |

| Financial analyst | INR 6 lakhs |

| Assistant account manager | INR 5 lakhs |

| Senior account executive | INR 4 lakhs |

| Senior accountant | INR 3.5 lakhs |

| Business analyst | INR 4 lakhs |

| Account assistant | INR 2 lakhs |

Must Check: Which is better CA or MBA?

Chartered Accountant Salary in India in Different Cities

Salary given to Chartered Accountants in different cities in India are:

- CA salary in Gurgaon – INR 9.5 lakhs

- CA salary in Mumbai – INR 8.8 lakh

- CA salary in Chennai – INR 8.5 lakh

- CA salary in Delhi – INR 7.5 lakh

- CA salary in Guwahati – INR 6.2 lakh

- CA salary in Punjab – INR 6 lakh

- CA salary in Pune – INR 6 lakh

- CA salary in Ahmedabad – INR 6 lakh

- CA salary in Jaipur – INR 5 lakh

Highest Paying Companies to CA in India

As we all know, CA is among the highest-paid professions in India. Many companies, such as Reliance, ICICI Bank, TATA, Bharti Airtel, and more, offer handsome salaries to CAs. Many Chartered Accountants dream of getting a job in these companies.

Now, let us check the companies that are paying the highest CA salary in India.

| Company | CA Salary |

| Microsoft | INR 3 to 4 lakhs |

| TCS | INR 7 to 8 Lakhs |

| Reliance Industries | INR 11 to 13 LakhsLakhs |

| Infosys | INR 8 to 10 Lakhs |

You can check out the step-by-step process of becoming a CA in our detailed guide.

Does the Number of CA Exam Attempts Affect the CA Salary?

You might think that your rank will pull you back in the starting years to get your dream salary. It is true, but your hard work and smartness can lead you to the level you deserve.

Many people who have taken 2-3 attempts in the CA Final started their careers with one of the Big 4 firms with a starting package of just INR 6-8 lakhs. However, in 4-5 years, they have maintained a good position, and their average salary has risen to INR 24-25 Lakhs per annum. Also, many candidates left the Big 4 firms within one year due to the overload of work pressure.

How Can You Earn a High CA Salary in India?

1. Get a High Rank in CA Exams

If you get a high rank in your CA Final exams, your chance of getting a good annual package increases. Chartered Accountants with an All India rank in CA Final exams are offered a salary of INR 20 to 25 lakhs per annum. Apart from that, you can even apply for jobs in big companies and the top 4 firms.

2. Clear CA exams in Fewer Attempts

If a candidate does not get an All India rank but clears the CA exams in one or two attempts, he can still earn a good monthly income. Based on the recruitment insights of the top CA firms in India, Chartered Accountants will surely get a salary of 14 to 15 lakhs rupees with fewer attempts.

You can apply for jobs in the Big 4 firms and other CA firms. Moreover, you can also go for Government companies/PSUs, as they shortlist candidates according to their CA exam attempts.

To score high marks in the CA exams, you can join the VSI Jaipur Institute. VSI students till now got All India 1st rank 7 times.

3. Master Financial Accounting and Analysis

As a CA, your major role will be to manage the financial books and prepare budgets and statements. So, study how the financial statements are recorded and managed and how to analyze them to drive helpful insights. For this, you can enroll in online courses from trusted mentors. Furthermore, you can also follow the industry experts to learn their way of excelling in the work.

4. Learn Microsoft Excel

Every CA must have a good command of Microsoft Excel as it will be helpful in recording, managing, and analysing financial data. Moreover, many companies have made it mandatory for the CAs to have a basic understanding of Excel. So, to learn Excel, you can take online courses easily available on the web and use them in your daily tasks.

5. Join a Good Articleship Firm

Your CA articleship experience will play a crucial role in determining your salary in the initial years. Therefore, we recommend all the students join a reputed articleship firm and work harder. Do not skip articleship or go for dummy articleship. Your articleship experience will give you an upper edge over other candidates.

6. Make Your Communication Skills Strong

Good communication skills imply your ability to present your ideas in meetings confidently. If you can communicate well, it will help in your interviews to get shortlisted. And will also help you to gain promotions in the long run. ICAI is also providing a communication course that you can pursue.

7. Locality of Service

The city or state in which you’re working will also have an impact on your salary. Some tier 1 cities offer high CA packages, such as Mumbai and Delhi, while the salary is low in tier 2 cities, such as Jaipur and Ahmedabad. So, it is a good idea to choose a company located in metro (tier 1) cities.

Earnings of a Practicing Chartered Accountant

CAs who start their practice can earn a handsome income based on their capabilities to get high-paying clients. On average, the annual income of a practicing Chartered Accountant is around INR 20 to 22 lakhs. Furthermore, if he gets big clients, then he can easily earn around INR 50 lakhs per annum. However, the minimum salary a practicing CA earns is around INR 10-11 Lakhs annually.

Furthermore, Practising CAs can earn a sound income by acquiring high-paying clients. On average, the annual income of a practicing Chartered Accountant is around INR 20 to 22 lakhs. Furthermore, if he gets big-budget clients, then he can easily earn around 50 lakhs rupees yearly. However, the minimum earnings of a practising CA is around INR 10-11 lakhs annually.

What are the Income Sources for CA Other than Salary?

Apart from salary, the other income sources for CA are:

- Consultation Fees – A CA who offers consultation services gets the fees. This fee will be based on the time duration of the consultation or based on the specific tasks.

- Commission—Companies offer a commission to CAs who solve certain financial problems, such as preparing merger books or presenting good books to investors.

- Bonus – CAs whose performance is good and benefits companies in earning higher profits get a bonus in addition to their salary.

Also Read: CA Course Fees in India

Frequently Asked Questions

Q 1. Are CAs rich in India?

Ans. Yes, many CAs are working in large companies or have started their own practices and are earning lakhs.

Q 2. Can a CA earn in Crores?

Ans. Yes, a CA can earn crores by working in top-level positions in large companies or handling the work of big-ticket clients.

Q 3. Are Chartered Accountants the Highest paid professionals in India?

Ans. Chartered Accountants are indeed the highest-paid professionals in India. The highest salary of a CA can reach up to 60 to 70 lakhs per annum.

Q 4. Who earns more, a Doctor, CA or Lawyer?

Ans. The CAs earn better than doctors and lawyers when compared between salary, course, work, and duration.

Q 5. Which industries pay high salaries to CA in India?

Ans. The top-paying industries for CAs are Accounting, Financial Services, Banks, IT & Consultation, and Construction.

Q 6. Which CA has the highest salary in India?

Ans. Kumar Mangalam Birla is the highest-paid Chartered Accountant in India.

Q 7. What is the salary of a CA in Delhi?

Ans. In Delhi, the average CA salary is INR 8,25,000 per annum.

Q 8. What is the CA salary in Mumbai?

Ans. In Mumbai, the average CA salary per annum is INR 8,80,000.

Q 9. Why are CA aspirants wasting 5, 6 or more years under so much pressure when the average CA salary is just 7 to 8 lakhs?

Ans. Students must note that 7-8 lakhs is the average salary of a CA fresher. If they can get an AIR and clear the exams in 1-2 attempts, their starting package will be 15 to 20 lakhs. Moreover, even if CA starts with a low package, the growth & salary in this profession is very high.

Q 10. Do those who clear the CA exam on the first attempt earn more salary?

Ans. Yes, candidates who have cleared the CA exams on the first attempt earn a higher salary. They might get an annual package of Rs. 13-15 lakhs per annum.

Q 11. Is it tough to become a CA?

Ans. Yes, it is tough to become a Chartered Accountant. You must clear the three levels of CA exams, which are considered the most difficult exams in India.

Q12. Which has a better salary, CA or CMA?

Ans. CA deals with Accounting, Auditing, and Taxation, while CMA deals only with Management Accounting. That’s why the demand for CA remains high, due to its covering a larger area. For this reason, the salary of a CA is also high. To learn more about the comparison of CA and CMA, click on the CA vs CMA link.