Chartered Accountancy is one of the most chosen career options in India. Students from any field can pursue the CA course and add a CA prefix to their name. So, if you’re also interested in becoming a Chartered Accountant and want to know the steps involved, check out the complete article.

Students who have completed their 12th or graduation with at least 55% are qualified to register for the course. However, to become a CA in India, they must clear three exams: Foundation, Inter and Final, and complete the 3-year practical training.

Furthermore, ICAI has made two ways through which aspirants can enrol for Chartered Accountancy:

- Foundation Route

- Direct Entry Route

In the Foundation route, you have to register for the Foundation level and pass all three CA exams. However, in the direct entry route, graduate students can directly register for the Intermediate level and skip the Foundation exams.

The Institute of Chartered Accountants of India (ICAI) is the governing body of the CA exams. It handles all the matters related to the Chartered Accountancy course and profession.

Now, let us understand the process of becoming a Chartered Accountant in detail. The article is written by the VSI Jaipur team for students who want to pursue the CA course. VSI is a leading CA Institute in India that has helped thousands of CA aspirants achieve their dreams.

जानिए भारत में सीए बनने की पूरी प्रक्रिया हिंदी में।

Qualifications Required to Become a CA

- Pass Class 12th (10+2 ) with 55% in the commerce stream and 60% in other streams from the recognised board to be eligible for the CA Foundation Route.

- Pass graduation or post-graduation in the commerce stream with at least 55% to be eligible for the direct entry route.

- In other streams, students have to score at least 60% in graduation or post-graduation to be eligible for a direct entry route.

Must Check: CA Foundation Eligibility

How to Become a Chartered Accountant in India

Step 1. Register for the CA Foundation Exams

The CA Foundation exam is an entry-level exam for becoming a chartered accountant in India. Class 12th appearing or passed students can enrol for the CA Foundation course. Registration for the CA Foundation course is done online through the ICAI official website and is valid for three years.

After registration, you’ll get a study period of 4 months to complete the CA Foundation syllabus. During this period, you must also fill out the CA Foundation exam form to get the admit card and sit in the exams.

CA Foundation Papers

There are 4 papers in the CA Foundation exams that students must clear:

- Paper 1: Accounting

- Paper 2: Business Law

- Paper 3: Quantitative Aptitude:

- Business Mathematics

- Logical Reasoning and

- Statistics

- Paper 4: Business Economics

CA Foundation Exam Pattern

The CA Foundation exam pattern is partially objective and subjective. The first two papers are subjective types, and the following two papers are objective types. However, all the papers consist of 100 marks.

According to the passing criteria, you need to get 40% in each subject and a total of 50% in all the papers to clear the exams. The CA Foundation Result is declared by ICAI 2 months after the exams. Join the CA Foundation coaching from VSI to clear the exams in one go. Along with the result, ICAI also declares the CA Foundation Passing Percentage.

The fee for the CA Foundation course is Rs 11,300. It includes the registration fee of Rs 9800 and the exam form fee of Rs 1500.

Upon clearing the CA Foundation course, you will be eligible to register for the CA Intermediate course.

Must Check: CA Foundation Preparation

Step 2. Register & Crack the CA Intermediate Exams

Eligible students can register for the CA Intermediate exams for the January, May and September sessions, respectively. The CA Inter registration is valid for four years, which means you have 8 attempts to clear the exams.

After registration, you will get 4-month periods to study for the exams. Moreover, you must fill out the CA Inter exam form and also download the admit card on the prescribed date by the ICAI.

CA Intermediate Subjects

CA Intermediate Syllabus consists of 6 subjects categorized into 2 groups. The CA Inter subjects are:

CA Inter Group 1 Subjects:

- Paper-1: Advanced Accounting

- Paper-2: Corporate Laws & Other Laws

- Paper-3: Taxation

- Section A: Income Tax Law

- Section B: Goods and Service Tax

CA Inter Group 2 Subjects:

- Paper-4: Cost and Management Accounting

- Paper-5: Auditing and Assurance

- Paper-6: Financial Management and Economics for Finance

- Section A: Financial Management

- Section B: Strategic Management

The exam pattern of CA Intermediate is both subjective and objective. All four papers of both groups consist of 100 marks each. To clear a CA Intermediate group, you need to get 40% in each subject and 50% aggregate.

Students who get more than 60 marks in a subject get an exemption. It means they don’t have to appear in that subject in the successive 2 attempts. The CA Intermediate result is announced 2 months after the last paper.

To prepare for this exam, you’ll need to join a good CA Intermediate Coaching that guarantees course completion within 5-6 months. It will give you enough time for self-study and revision.

Furthermore, students also need to complete 4 weeks of the short integrated course on information technology and soft skills (ICITSS). The ICITSS training needs to be completed before commencing the practical training.

The CA Inter course fee is Rs. 18,000 for both groups and Rs. 13,000 for a single group. Furthermore, the examination fee is Rs 2700 for both groups and Rs 1500 for a single group.

Must Check: Study Plan for CA Intermediate Exams

Step 3. Complete the CA Articleship Training of 2 Years

Candidates can start their CA articleship training as soon as they pass any CA Intermediate groups and complete the ICITSS training. Afterward, they can register for practical training.

The 3 years of articleship training will give you vast exposure to practical work that a Chartered Accountant does in the real world. After completing 2 years of articleship training, students become eligible to appear for the CA Final exams. The fee to register for the CA Articleship is Rs 2000.

We have seen that some students go for dummy articleship. But they are making a big mistake as they’ll not get practical exposure while working on an article. So, never opt for a dummy articleship.

“The more you sweat in practice, the less you sweat in war.”

Step 4. Crack Both Groups of the CA Final Exams

Students need to clear both groups of CA Intermediate to be eligible to appear for the CA Final exams. Its registration is valid for 5 years, which means 10 attempts.

Moreover, to fill out the CA Final Exam Form, they need to complete 4 weeks of ICITSS & Advanced Integrated Course on Information Technology and Soft Skills (AICITSS) training and 2 years of articleship.

CA Final Subjects

The CA Final New Syllabus includes 6 subjects that are categorized into two groups:

Group I Subjects:

- Paper-1: Financial Reporting

- Paper-2: Advanced Financial Management

- Paper-3: Advanced Auditing, Assurance, and Professional Ethics

Group II Subjects:

- Paper-4: Direct Tax Laws & International Taxation

- Paper-5: Indirect Tax Laws

- Paper-6: Paper-6: Integrated Business Solutions (Multidisciplinary Case Study with Strategic Management)

- Section A: Corporate and Economic Laws

- Section B: Strategic Cost & Performance Management

CA Final Exam Pattern

Again, the CA Final exams are both subjective and objective. Here also, each paper consists of 100 marks. Paper 6 is an open-book exam, and you can choose from 6 optional subjects.

To clear the CA Final exams, you have to obtain 40% in each subject and 50% in aggregate. Those who got more than 60 marks in a paper get an exemption in the subsequent 3 attempts. The CA Final Result will be released by ICAI about 2 months after the last paper.

The fees for the CA Final course are ₹ 22000 for both groups. The examination fee is ₹ 3300 for both groups and ₹ 1800 for one group. At the final level, the registration fee is the same whether you enroll for one or two groups.

Furthermore, ICAI has released the CA Final Exam Date for the May 2025 Exam. To know the complete details click the link to check the exam dates.

Must Check: All Information regarding CA Exams

Step 5. Apply for the ICAI Membership

After clearing both groups of the CA Final course, students can apply for ICAI membership. Thus, this is the complete procedure to become a CA in India.

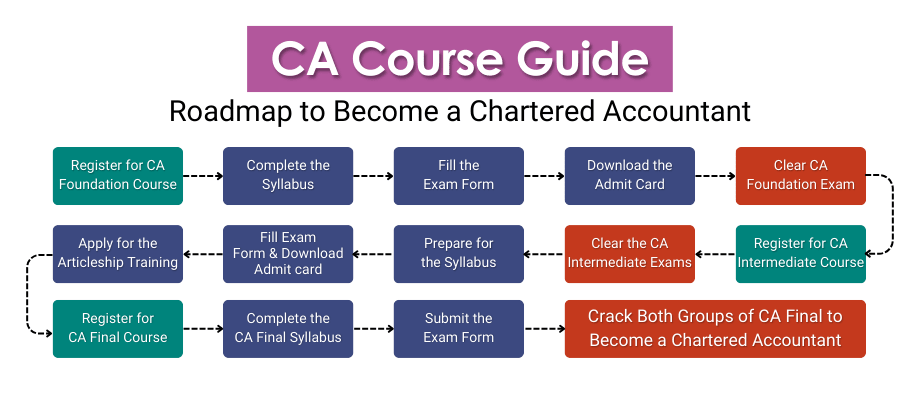

Here is the summary of the steps to become a Chartered Accountant in India:

- Register for the CA Foundation Course.

- Crack the CA Foundation exams.

- Register for the CA Intermediate Course.

- Crack any one group of CA Intermediate.

- Enrol for the CA Articleship training after clearing any one group of CA Intermediate.

- Crack both groups of the CA Intermediate Course.

- Complete the CA Articleship Training (2 years).

- Register for the CA Final Course.

- Clear Both groups of CA Final Exams.

- Apply for the ICAI Membership.

Check the VSI web story for the steps to becoming CA.

ICAI has recently proposed the CA New Scheme Course 2025. In the new scheme, ICAI has proposed many changes, such as reducing articleship training duration, removing subjects, etc. Check out the article for full details about the New CA Course curriculum.

Also Check: CA Salary in India

How to Become CA After Graduation through Direct Entry Route?

ICAI has provided direct entry into the CA Course for graduate or postgraduate students. Under this scheme, graduate students can register for the Intermediate course, skipping the CA Foundation exams.

The eligibility criteria for the direct entry scheme are:

- A minimum of 55% for commerce graduates or post-graduates

- A minimum of 60% for Arts/Humanities/Science graduates or post-graduates

Moreover, these students have to register for both groups of CA Intermediate exams. Apart from that, the steps to becoming a CA are the same and include:

- Crack any one group of CA Intermediate.

- Register for the Practical training after clearing any one group of CA Intermediate.

- Crack both groups of the CA Intermediate Course.

- Complete the CA Articleship Training (3 years).

- Enrol for the CA Final Course.

- Crack both groups of the CA Final.

- Apply for the ICAI Membership.

Students who pursued BCOM or BBA after their 12th class can directly enrol for the CA Intermediate exams. They don’t need to take the CA Foundation exams. The steps to becoming a Chartered Accountant after Bcom or BBA will remain the same.

Must Check: Top 10 CA Firms in India in 2025.

How to Become a CA (Chartered Accountant) after 12th Science?

The steps to becoming a Chartered Accountant in India after 12th science are completely the same as those mentioned above. However, it will be a bit more difficult for science students. Initially, they didn’t have the basic accounting knowledge needed for the CA Course.

Students can read our article on “CA Entrance Guide after 12th Science“.

Can I do CA after the 10th Class?

Students can now pursue the Chartered Accountancy course just after their 10th class. To become a CA after the 10th, students can provisionally register for the CA course. ICAI has initiated the provisional registration facility for the 10th pass-out students.

However, students can take their CA Foundation exams after class 12th only. The rest of the steps are the same as becoming a Chartered Accountant after the 12th.

Which Subjects are Best for CA in School?

Students who want to become CAs can take commerce subjects like Accounts, BST, Economics, and Maths. The commerce field is generally preferred if a student wants to become a Chartered Accountant. Students who have taken science in their 11th and 12th grades can take maths.

You can check out our detailed article on what subjects in school or college are best for CA.

Can I Become a CA After Engineering?

To become a Chartered Accountant after engineering, you need to crack the three CA exams and complete the 3 years of practical training. Engineering students can directly enroll for the CA Intermediate course and skip the CA Foundation exams. For this, they need to register through the direct entry route.

Rest, the steps to becoming CA after engineering are the same as mentioned in the direct entry route section. They need to clear the CA Intermediate for both groups and articleship of 3 years. After that, they can enroll for the CA Final exams. Upon clearing the CA Final for both groups, they’ll become a Chartered Accountant.

Engineering students don’t have a strong concept in accounting, so it is advised to focus more on understanding the concepts.

Knowledge Base for the Students

Important ICAI links for the Chartered Accountancy Course:

- At a Glance: Chartered Accountancy Course

- Chartered Accountancy Prospectus

- Scheme of Education and Training

- Training Guide

- Code of Conduct for CA Students

- Students Association Rules

Skills Needed to Become a Chartered Accountant

Essential skills that you’ll need to become a CA in India:

- Critical Thinking and Problem-solving.

- Sound Communication skills.

- Organisational skills.

- Discipline and the ability to accept failures.

- IT proficiency.

You should also know the main Qualities of a Chartered Accountant student, and try to learn and inculcate qualities.

Why Build a Career in CA?

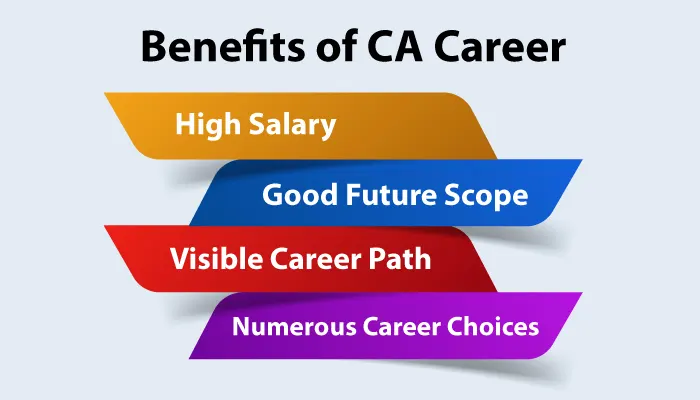

Let us look at the benefits of a career in Chartered Accountancy and, why you should consider it.

1. High CA Salary

Chartered Accountants are one of the highest-paid professionals in India. The average salary offered to a fresher CA is around 7 to 8 lakhs per annum. After gaining experience of 4-5 years and the necessary skills, a CA can earn 30 lakhs per annum.

2. Growing Future Scope

The scope of the CA career is growing and is estimated to grow consistently in the coming years. With the establishment of new businesses and the development of financial sections, the demand for CAs will only increase.

3. Safe & Secure Career Path

CA is among those professions that everyone knows about. There are higher chances that you’ll find a CA in your family relations only. So, becoming a CA is considered a safe and secure career option.

4. Numerous Career Choices

As a Chartered Accountant, there are many options open for you. You can do a job, practice independently, offer consultation, teach, and many more. Talking about the job roles, you can go for, accounting, auditing, financial management, etc. You can also do further courses and apply to international companies.

5. High Growth Opportunity

Another advantage that motivates many students to become a CA after 12th or graduation is the opportunity to grow.

Compare: CA vs CMA

Working Scope of Chartered Accountancy

After studying and working rigorously for 5-6 years, Chartered Accountants have enough knowledge to work in various fields. So as a CA, you can work in these sectors:

- Companies

- CA Firms

- Financial Institutions

- Consultancy firms

- Own Practice

As a CA, these are some sectors you can go to. CAs are in high demand. There are many vacancies available in businesses and financial institutions. However, if you want to get a good experience, then a CA firm must be your priority.

Other than that, you can also offer consultancy services related to your strong areas. Or else, you can start your practice and make clients. This entirely depends on how you can get the big clients. There is no upper limit in terms of remuneration when you are practicing.

Job Roles for Chartered Accountants in India:

- Financial Officer – He manages the financial transactions of businesses, preparing budgets and reports for the company.

- Account Executive: This person handles and manages the financial accounts as per the company’s act, implements accounting systems, etc.

- Financial Analyst: Analyzes the financial performance of the business according to estimates and forecasts and plans the future course of action.

- Asst. Account Manager—Their major responsibility is to do the clerical support work for the manager, including managing documents, attending calls, scheduling meetings, etc.

- Finance Controller: Their work includes daily routine accounting tasks, preparing financial reports and budgets, and overseeing financial performance.

- Business Analyst – They work with both customers and shareholders to collect crucial details, manage them in documents, analyze and derive useful insights, etc.

CA Salary in India

The average salary of a fresher CA in India ranges between 7 and 8 lakhs per annum. Chartered Accountants with 4-5 years of experience can earn around 20 lakhs in India.

The salary offered to Chartered Accountants by international firms is even higher. In foreign companies, CAs get a package of 70 to 80 lakhs per annum.

CA Course Details

Mentioned below is a tabular representation of the complete CA Course details, including eligibility, registration, subjects, exams, and fees for all three levels.

| CA Foundation | CA Intermediate | CA Final | |

| Eligibility | Appear in 12th exams | Clear foundation or graduation or PG | Clear intermediate level practical training |

| Last date to Register for 2025 Exams | Before 1 Feb, 2025 for June 2025 Exam | Before 1 Jan, 2025 for May 2025 Exam | Before 1 Jan, 2025 for May 2025 Exam |

| Examination held | January, June and September | Januray, May and September | May and November |

| Registration Validity | 3 years (6 attempts) | 4 years (6 attempts) | 5 years (10 attempts) |

| Subjects | 4 | 6 (3 each group) | 6 (3 each group) |

| Fees | Rs 11300 | Rs 27200/23200 | Rs 39800 |

Also Read: CA Course Fees

CA Course Duration

After the 12th class, it will take a minimum of 5 years to become a CA in India. However, graduated students will need 4.5 years. The period of 6 months is saved through the direct entry route.

The students must note that the CA course duration will be increased by 6 with every failed attempt.

Tips for the Chartered Accountant Aspirants

Chartered Accountant aspirants can follow these tips while pursuing the CA course:

- CA is a challenging course, and aspirants must keep a positive mindset throughout the journey. They must believe that they can clear all the levels on the first attempt and have faith in themselves.

- Follow only the ICAI study materials for the preparation. All the CA toppers and mentors always recommend that you give top priority to the ICAI materials. And then, you can go for some other book, if needed.

- Smart and hard work will be the key to clearing the CA exams. Firstly, make a clear study plan for the exams and follow it strictly. Your study plan should be based on the weightage, volume, and difficulty level of the topics.

- Irrespective of your course level, you need to complete the CA syllabus early so that you can do at least 2-3 times revisions.

- Join coaching that can teach and guide you. Students need the guidance of experienced teachers to clear the exams. You can prefer offline or online classes for the CA course at your convenience.

- Focus on building soft skills, such as communication skills. This will surely help you get a better package than others.

Frequently Asked Questions

Q1.Which stream is best for the Chartered Accountancy course?

Ans: Commerce is the best stream for the students who want to do CA.

Q2. Is maths compulsory for CA?

Ans: Students need to study maths for the CA Foundation course. Other than that, there is no paper for maths in CA Intermediate and Final exams. However, there will be long calculations at every stage, so students must have a basic knowledge of mathematics and calculation.

Q3. Is it easy to become a CA (Chartered Accountant)?

Ans: CA is undoubtedly one of the most difficult courses in India. However, if a student prepares for this exam smartly, with full discipline and dedication, it can be cleared in the first attempt.

Q4. Is there any age limit to pursuing a CA?

Ans: No, there are no age limit criteria to pursue the CA course in India.

Q5. Should I pursue my CA Course after the 12th or graduation?

Ans: Candidates can pursue CA courses after the 12th and after graduation. It depends upon their preferences when they want to start their courses.

Q6. Is a job guaranteed after becoming a Chartered Accountant?

Ans: Yes, you’ll get a job but the package will depend on the candidate’s performance in exams, his personality, and communication skills.

Q7. Is CA a government job?

Ans: No, CA is not completely a government job. However, a Chartered Accountant can work in PSUs to handle their finances and accounts.